Aircraft Inventory Monetization & Asset Recovery

Transform surplus aircraft inventory into immediate value through our innovative aircraft consignment, trading, and asset recovery solutions. Global marketplace for aircraft parts, engines, and equipment.

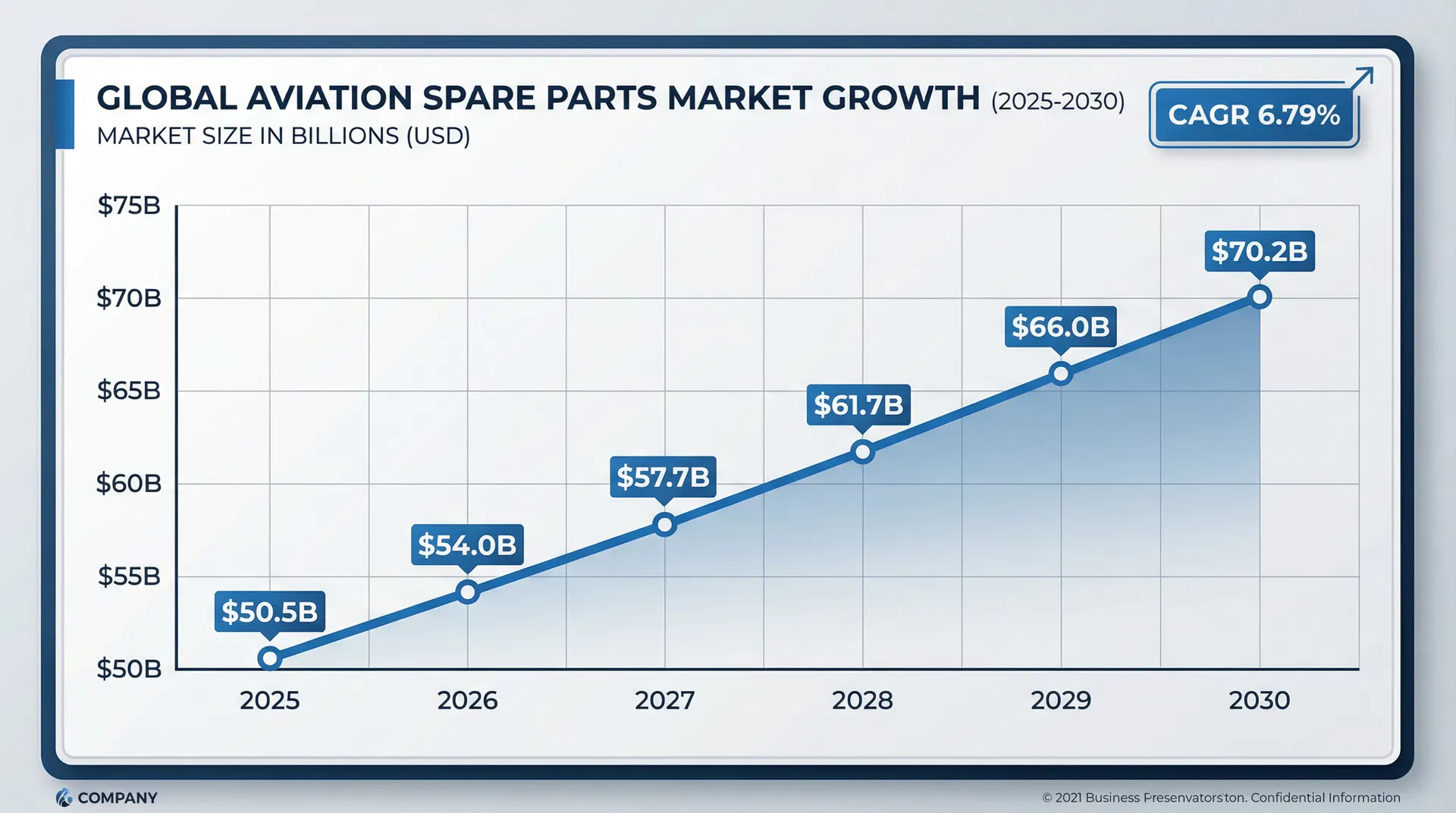

The $50.5 Billion Market Opportunity

A rapidly growing aviation spare parts market with significant untapped potential

$50.5B (2025)

Current global spare parts market size

6.79% CAGR

Projected annual growth through 2030

$70.2B (2030)

Projected market size in 5 years

The $4-7 Billion Global Surplus Inventory Problem

Legacy airlines hold $1.5-2 billion in slow-moving inventory, costing $600M+ annually in storage and maintenance1

Bulk Sales Sacrifice 20-50% Value

Market research shows 20% minimum value loss; forced liquidation can reach 50%. Quick sales to brokers result in significant value loss. Airlines lose millions on forced bulk sales.2

Traditional Brokers Add Double Costs

Brokers charge 15-25% commissions3 plus double logistics costs. Warehousing, insurance, and preservation expenses drain cash flow (up to 30% of inventory value annually4) while asset value depreciates 2-3% annually.

Limited Geographic Reach

Traditional sales channels reach only local or regional buyers. Missing qualified buyers across UAE, Europe, and North America means leaving money on the table.

Lack of Transparency & Long Sales Cycles

Opaque pricing, slow negotiations, and complex logistics create distrust and delays. Average sales cycle: 6-12 months. Capital remains locked while costs accumulate.

The 1000 Lakes Solution

Virtual Consignment Model

Your inventory stays in place while we market globally. No storage costs, no logistics headaches. You retain ownership until sale.

Global Buyer Network

Access to 1000+ qualified buyers across UAE, Europe, and North America. Competitive bidding drives prices up 20-40% vs. traditional brokers.

Direct Dropship Capability

Eliminates double freight and logistics complexity. Direct buyer-to-seller shipping accelerates transactions and reduces costs.

Fast Realization & Transparency

Average sales cycle: 30-60 days vs. 6-12 months traditionally. Real-time pricing, transparent fees, and competitive bidding.

Lower Commission Structure

12.5% commission vs. 15-25% traditional brokers. Platform-based efficiency reduces costs and keeps more value in your hands.

Economic Benefits & ROI

Typical Deal Economics

- Average Deal Size: $5K - $50K per item

- Commission Rate: 12.5% (vs. 15-25% brokers)

- Platform Margin: 93.6% gross margin

- Sales Cycle: 30-60 days (vs. 6-12 months)

- Value Recovery: 60-80% of market value

Client Value Proposition

- 20-40% Higher Prices vs. bulk liquidation

- 50% Lower Costs vs. traditional brokers

- 10x Faster Sales (30-60 days vs. 6-12 months)

- Zero Inventory Risk - Virtual consignment model

- Transparent Pricing - Real-time competitive bidding

Simple, Transparent Process

Agreement

Standard consignment terms, no upfront fees. Virtual consignment - your inventory stays in place.

Marketing

Global reach to 1000+ qualified buyers across Dubai, Helsinki, and North America. Real-time competitive bidding.

Sale & Payment

Direct ship to buyer, fast payment. Average cycle: 30-60 days. Transparent 12.5% commission.

Global Aviation Network

Dubai

Middle East & Asia Hub

Market Size: $25M+ annually

Helsinki

European Operations

Market Size: $30M+ annually

North America

US & Canadian Markets

Market Size: $45M+ annually

Industry Trends & Market Drivers

Rising Fleet Modernization

Airlines upgrading to newer, more fuel-efficient aircraft (Boeing 787, Airbus A350) creates massive inventory of legacy parts and engines.

MRO Market Growth

Maintenance, Repair, Overhaul (MRO) market projected to reach $121B by 2030. Demand for affordable, quality parts is increasing.

Supply Chain Digitalization

Aviation industry shifting to digital marketplaces. Blockchain and real-time tracking improving transparency and trust.

Emerging Market Demand

Growing airlines in Southeast Asia, Middle East, and Latin America need affordable, certified parts. 1000 Lakes connects them directly.

Ready to Monetize Your Aircraft Inventory?

Get started with 1000 Lakes Aviation Partners today. Our team is ready to discuss your specific needs and unlock the value in your surplus inventory.

Data Sources & References

1 Legacy Airlines Inventory & Holding Costs: Skylink International (May 2020) & ePlaneAI (February 2025). Major legacy airlines hold $1.5-2 billion in inventory that turns fewer than 1.7 times per year, with carrying costs up to 30% of inventory value annually ($600M+ for $2B inventory).

2 Value Loss from Bulk Liquidation: Skylink International (November 2025). Industry analysis shows minimum 20% value loss without any damage, with forced liquidation reaching 30-50%. Value decline driven by market shifts, fleet modernization, and competing supply.

3 Aviation Broker Commissions: BlackJet (2026) & aviation industry standards. Private aviation brokers charge 15-25% commissions on aircraft and parts transactions, compared to 1000 Lakes' 12.5% rate.

4 Inventory Carrying Costs: Skylink International & ePlaneAI. Carrying costs include capital costs (12-15%), storage & facility (5-8%), insurance (3-5%), handling & labor (3-5%), depreciation (2-5%), and taxes/admin (2-3%), totaling 27-41% annually.

Additional Sources: IATA & Oliver Wyman Joint Study (October 2025) - Supply chain challenges costing airlines $11 billion in 2025, with $1.4 billion attributed to surplus inventory holding costs. Global MRO market: $450.46 billion (2026), projected $501.51 billion (2031) - Mordor Intelligence.